Content

Payroll Manage employee salaries, deductions and benefits effortlessly. CRM Increase your revenue with better customer relationships. Expenses Track expenses efficiently, both paid by employee or company. These can include parts, cloth, and even food ingredients required to make your final product.

- The traditional income statement, also called absorption costing income statement, uses absorption costing to create the income statement.

- CRM Increase your revenue with better customer relationships.

- Under absorption costing, companies treat all manufacturing costs, including both fixed and variable manufacturing costs, as product costs.

- It not only includes the cost of materials and labor, but also both variable and fixed manufacturing overhead costs.

- Absorption costing provides a poor valuation of the actual cost of manufacturing a product.

- Let’s continue our previous example and see how overheads will be absorbed using the overhead absorption rates that we’ve calculated previously.

As you might see from the above formula, let us explain fixed manufacturing overhead to calculate the cost per unit of inventories. Certain fixed overhead costs like factory rental are still incurred even though there are no productions and the highest rental costs. There is no production in some cases, but the https://quickbooks-payroll.org/ fixed overhead costs are incurred, then the unit cost could be overstated. This leads to over costing of inventories and overpricing of the products. In addition, absorption costing takes into account all costs of production, such as fixed costs of operation, factory rent, and cost of utilities in the factory.

Example of Absorption Costing

The costs which are included in the absorption costing method are direct labor costs, direct material costs, fixed overhead costs, and variable overhead costs. The absorption cost can be calculated by adding direct costs and production overhead costs. The direct costs may include direct labor costs and direct material costs, whereas the production overhead costs may include variable overhead costs and fixed overhead costs.

- If management was limited to absorption costing information, this opportunity would likely have been foregone.

- The marginal costing method is the method under which fixed and variable costs are classified separately and variable costs are imposed on cost units.

- Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold.

- Professional sports clubs will occasionally offer deep discount tickets for unpopular games.

- Marginal costing differentiates between the direct and indirect costs of production.

- The unit product cost under variable costing and absorption costing is $69.00 and $81.00 per unit respectively.

The direct cost per unit will comprise of direct materials, direct labour etc. Add to that the overhead absorbed per unit, which we do using our overhead absorption rates, and we have an estimate for the total production cost at the start of the period.

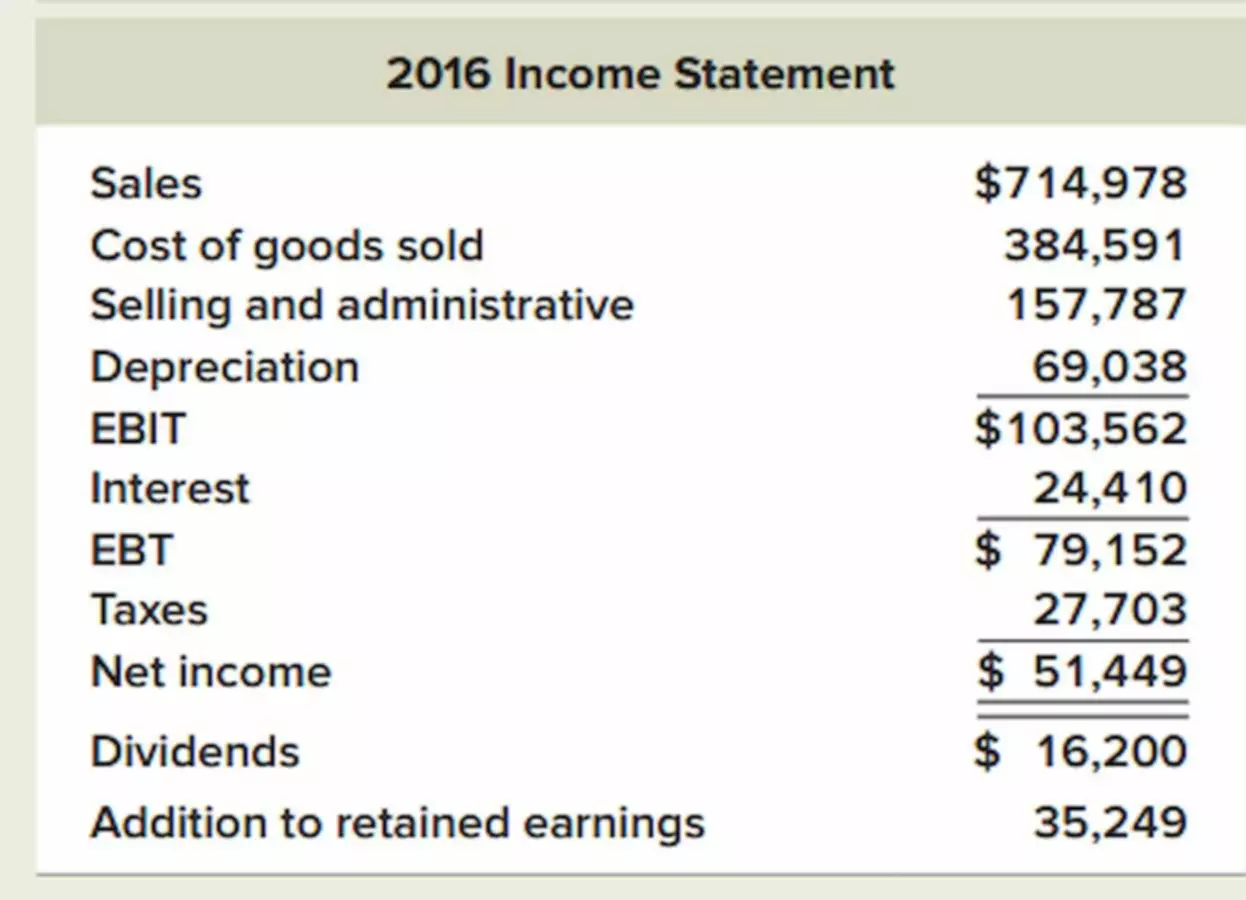

Example of Calculating the Sales

And, because each unit requires a certain amount of resources, a higher number of units will raise the variable costs needed to produce them. Marginal costing is a costing method that considers the change in cost for producing one additional unit. It considers the change in cost against the change in production level. If the company absorption costing formula actually sell 10,000 units of the product at this price, the company’s return on investment on this product will indeed be 20%. If it turns out that more than 10,000 units are sold at this price, the ROI will be greater than 20%. The required return on investment will be attained only if the forecasted unit sales volume is attained.

Absorption costing is required by generally accepted accounting principles for external reporting. She is an expert in personal finance and taxes, and earned her Master of Science in Accounting at University of Central Florida.

The Advantage of the FIFO Inventory Method

They’ve also estimated what the labour and machine hours will be for the next period. Fixed costs do not fluctuate with changes in production levels, making them more difficult for smaller firms to manage. However, these costs must still be accounted for when determining the price of a product.

This will give a business the ability to plan more effectively. Once we understand what the full production cost is, we obviously know that if we want to make some money, our price needs to be higher than that. Furthemore, it would allow us to set up budgets which are very, very important for the planning cycle of the business. Direct costing is another type of cost accounting that only includes direct materials and direct labor costs in the cost per unit calculation. This method can be helpful for companies that do not have fixed overhead expenses or other indirect costs that need to be considered when calculating their profit margins on each product manufactured. It might not be the best method when it comes to decision-making if the company use absorption costing.

Pros and Cons of Marginal Costing

Are you asking how many units to include on the income statement? You always include the number of units sold because that’s how much revenue you are including. Using the cost per unit that we calculated previously, we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold. The profit calculated with marginal costing is different from the profit calculated with absorption. Despite these disadvantages, Absorption Costing remains a popular method for managing production costs. When used correctly, it can be a valuable tool for any business looking to stay competitive in today’s marketplace. To determine the cost of each activity, you will need to figure out the usage for each activity.

It means most companies would need to follow the absorption costing method at some stage for compliance purposes. The main costing methods available are process costing, job costing and direct costing. Each of these methods apply to different production and decision environments.

These costs are subtracted from sales to produce the variable manufacturing margin. As a result, these amounts must also be subtracted to arrive at the true contribution margin. Management must take into account all variable costs (whether related to manufacturing or SG&A) in making critical decisions. From the contribution margin are subtracted both fixed factory overhead and fixed SG&A costs.

The biggest disadvantage of the absorption method is it does not help management in the decision-making process. It is difficult to calculate actual production costs that are direct and variable to product only.